IMPORTANT UPDATE 11/15/23

Just a quick note here. Want to get this out because tomorrow is almost here. VERY IMPORTANT INFORMATION, EXTREMELY RELATIVE to RIGHT NOW.

Folks, you better wake up. The Beast system is being set in place RIGHT NOW. Right before your very eyes. Prepare yourselves. The best way to prepare is to get as close to GOD as you can. Ask Him to fill you with the FAITH TO STAND to the END!

spacer

If you have not seen the following related post, check it out:

spacer

HERE WE GO! UNDENIABLE FULFILLMENT OF PROPHECY

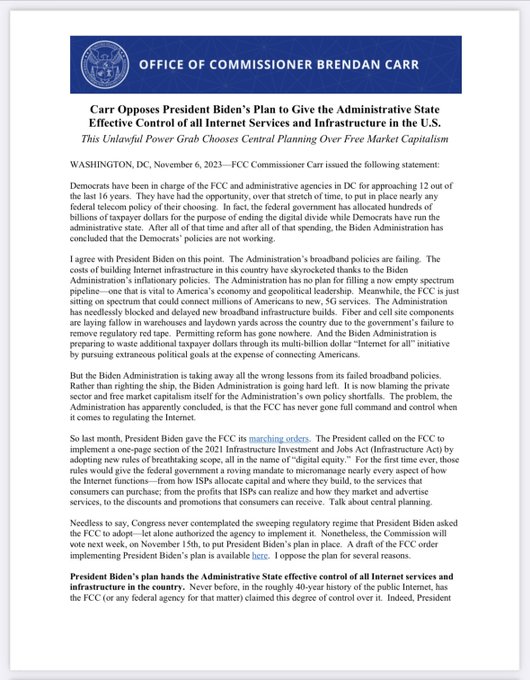

On October 24, 2023, the FCC announced that it will vote on rules to prevent and eliminate digital discrimination at the Commission’s Open Meeting on November 15, 2023. Source

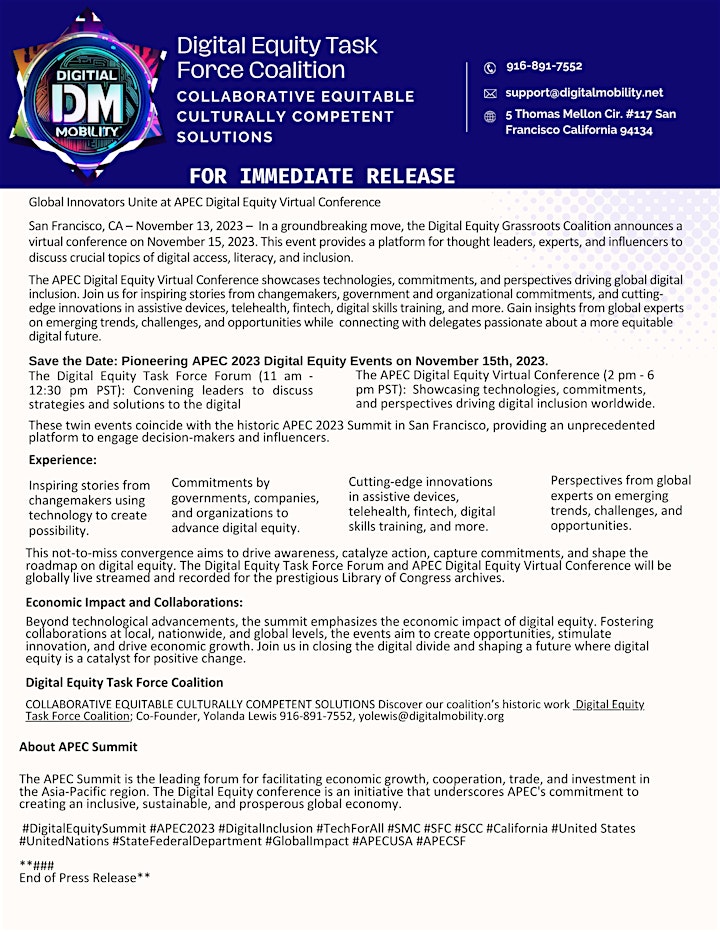

Digital Equity APEC Summit Virtual Conference

November 15, 2023 |

November 15, 2023 |  11:00 AM – 6:00 PM PST

11:00 AM – 6:00 PM PST

Virtual Event Register Now

Virtual Event Register Now

Join us for a transformative day at the Digital Equity APEC Summit, a virtual beacon during the APEC 2023 week. This summit unites visionary change-makers from around the globe to discuss, define, and determine the future of digital equity.

Experience a High-Energy Event

Experience a High-Energy Event

- Dynamic Sessions: Dive into discussions on cutting-edge technologies, equitable policies, and partnerships that are shaping digital access globally.

- Economic Empowerment Tracks: Choose from multiple tracks featuring inspiring tales of innovation, creating economic opportunities for underrepresented groups.

- Interactive Participation: More than just a viewer, be an active participant through Q&A, networking, and more, on our immersive virtual platform.

- Insightful Expertise: Gain actionable insights from leading experts on trends and challenges in the digital equity landscape.

- Valuable Connections: Engage with a community of attendees who are as passionate about technology inclusion as you are.

Featured Speakers

Featured Speakers

- Regina Wallace-Jones: Driving change as the President and CEO of ActBlue.

- David Lindeman: Advocating for the aging as a member of the California Commission on Aging.

- Chris Yu: Pioneering finance as President and CFO of KPAY Merchant Service.

- … and many more esteemed leaders!

Session Highlights

Session Highlights

- Premier Conversations: Kickstart with our co-hosts discussing the mission and vision of Digital Equity.

- Policy Blueprints: Discover transformative policies in digital inclusivity and sustainability with Joshua Butler.

- Digital Mastery for Small Business: Learn from Jamila Stanford’s strategies for thriving in a digital-first economy.

- The Intersection of Tech and Social Justice: Engage with Radhika Shah, Dr. Jennifer Eberhardt, and Jenna Nicholas on redefining digital spaces.

Special Features

Special Features

- Exclusive Content: Access session recordings, interviews, and summaries, all from this milestone global forum.

- Networking Opportunities: Connect with speakers and attendees during our dedicated virtual networking hour.

Sponsors

Sponsors

A big thank you to our Golden Sponsors like the Northern California Chapter Elite SDVOB, Cybertrust America, and more, as well as Silver and Bronze Sponsors who help make this summit possible.

Elevate your understanding, expand your network, and be empowered to act.

FILE – Treasury Secretary Janet Yellen speaks after touring the IRS New Carrolton Federal Building, Sept. 15, 2022, in Lanham, Md. The Biden administration is moving one step closer to developing a central bank digital currency, otherwise known as the digital dollar. It’s a step that administration officials said would help reinforce the U.S. role as a leader in the world financial system. (AP Photo/Alex Brandon, File)

WASHINGTON (AP) — The Biden administration is moving one step closer to developing a central bank digital currency, known as the digital dollar, saying it would help reinforce the U.S. role as a leader in the world financial system.

The White House said on Friday that after President Joe Biden issued an executive order in March calling on a variety of agencies to look at ways to regulate digital assets, the agencies came up with nine reports, covering cryptocurrency impacts on financial markets, the environment, innovation and other elements of the economic system.

Treasury Secretary Janet Yellen said one Treasury recommendation is that the U.S. “advance policy and technical work on a potential central bank digital currency, or CBDC, so that the United States is prepared if CBDC is determined to be in the national interest.”

“Right now, some aspects of our current payment system are too slow or too expensive,” Yellen said on a Thursday call with reporters laying out some of the findings of the reports.

Central bank digital currencies differ from existing digital money available to the general public, such as the balance in a bank account, because they would be a direct liability of the Federal Reserve, not a commercial bank.

According to the Atlantic Council nonpartisan think tank, 105 countries representing more than 95% of global gross domestic product already are exploring or have created a central bank digital currency.

The council found that the U.S. and the U.K. are far behind in creating a digital dollar or its equivalent.

Treasury, the Justice Department, the Consumer Finance Protection Bureau, the Securities and Exchange Commission and other agencies were tasked with contributing to reports that would address various concerns about the risks, development and usage of digital assets. Several reports will come out in the next weeks and months.

Eswar Prasad, a trade professor at Cornell who studies the digitization of currencies, said Treasury’s report “takes a positive view about how a digital dollar might play a useful role in increasing payment options for individuals and businesses” while acknowledging the risks of its development.

He said the report sets the stage for the creation of agency regulations and legislation “that can improve the benefit-risk tradeoff associated with cryptocurrencies and related technologies.”

The Blockchain Association, which lobbies lawmakers on Capitol Hill, said in a statement that the White House reports are “a missed opportunity to cement U.S. crypto leadership.”

“These reports focus on risks — not opportunities,” the statement reads, “and omit substantive recommendations on how the United States can promote its burgeoning crypto industry, including job creation, improvements to the financial system, and expanded access for all Americans.”

On Capitol Hill, lawmakers have submitted various pieces of legislation to regulate cryptocurrency and other digital assets.

Sheila Warren, CEO of the Crypto Council for Innovation, said in an emailed statement that the report “seem to kick the can down the road” she said, “we don’t see clear recommendations.”

The director of the National Economic Council, Brian Deese, told reporters that “we’ve seen in recent months substantial turmoil in cryptocurrency markets and these events really highlight how, without proper oversight, cryptocurrencies risk harming everyday Americans’ financial stability and our national security.”

“It is why this administration believes that now more than ever,” he said, “prudent regulation of cryptocurrencies is needed.”

He said on Friday that the Administration plans to “execute a comprehensive action plan with priority steps to mitigate key risks of cryptocurrencies — among others, money laundering and financing for terrorism.”

Biden issues executive order to explore cryptocurrency-like digital dollar

One key difference between the digital dollar and cryptocurrency is that the former would be subject to some regulation by central banks. So, for instance, the Federal Reserve could issue some monetary policy around issuance rates, address any inflation concerns and more. Senior Biden administration officials told reporters that already there are more than 100 countries that are looking into issuing their own centralized digital currencies.

By 6 a.m. ET, when the announcement of the order was official, Bitcoin had risen by over 9.5% over the previous day, according to Coinbase.

Treasury Secretary Janet Yellen said in a statement that the order supports an approach that “will support responsible innovation that could result in substantial benefits for the nation, consumers, and businesses.” She said that it would also address “address risks related to illicit finance, protecting consumers and investors, and preventing threats to the financial system and broader economy.”

Several agencies of the federal government have already begun researching the introduction of a U.S. digital dollar, but senior Biden administration officials stressed that this is the first time the federal government has taken a “holistic” approach to assessing a the possibility of a centralized digital currency, connecting both government banking institutions with departments and agencies focused on security considerations to mitigate risk.

The digital currency announcement comes on the heels of a series of harsh sanctions the U.S. and its allies have been imposing on Russia as a result of its invasion of Ukraine, but senior administration officials say the timing of the executive order is unrelated. They say that the use of cryptocurrency isn’t supplying Russia with a “viable workaround” to dodge the battery of sanctions the Russian economy is facing.

The new executive order also directs the Treasury to develop policy recommendations taking into account what kind of impact a digital dollar would have on the U.S. economy. Other agencies are tasked with considering privacy, security and potential negative climate impacts, given the enormous amount of electric power required to validate many types of cryptocurrency transactions.

For instance, every bitcoin transaction activates thousands of supercomputing mining machines, all competing against each other to solve complex mathematical problems, each vying to be the first to validate that transaction — and in return, earn some bitcoin. The Natural Resources Defense Council notes that a single bitcoin, currently worth around $42,000, has the same carbon footprint as 330,000 credit card transactions.

spacer

In its quest to regulate transactions involving digital assets and bolster federal oversight, the Biden administration has laid the foundation for how it plans to rein in the Wild West of crypto trading.

Following a March executive order directing federal agencies to assess the benefits and potential risks of integrating digital assets into the mainstream, Biden’s first-of-its-kind digital asset agenda is comprised of nine reports announced September 16 on the White House website.

“The reports call on agencies to promote innovation by kickstarting private-sector research and development and helping cutting-edge U.S. firms find footholds in global markets,” read the release. “At the same time, they call for measures to mitigate the downside risks, like increased enforcement of existing laws and the creation of commonsense efficiency standards for cryptocurrency mining.”

Critical to the agencies’ work over the past six months has been to consider the research and development of a U.S. central bank digital currency (CBDC), or a digital form of the U.S. dollar. The Biden team is hopeful that a CBDC could expedite cross-border transactions while safeguarding sensitive data. However, the administration anticipates “unintended consequences,” such as a reliance on CBDC “in times of stress.”

By the release’s own admission, further work is needed by the Federal Reserve to experiment with and measure the feasibility of a CBDC for it to meet it policy objectives, which range from protecting consumers, promoting financial inclusion, and minimizing vulnerabilities to national security. The Treasury Department is tasked with leading an interagency working group to weigh the effects of a CBDC and crowdsource ideas from government experts.

“Together, we are laying the groundwork for a thoughtful, comprehensive approach to mitigating digital assets’ acute risks and-where proven-harnessing their benefits,” said National Economic Council Director Brian Deese and Jake Sullivan, a national security advisor September 16 in a statement. “We remain committed to working with allies, partners, and the broader digital asset community to shape the future of this ecosystem.”

Treasury has released three of the nine framework reports. The first explores the implications of a CBDC on the current system of money and payments “Right now, some aspects of our current payment system are too slow or too expensive,” Treasury Secretary Janet Yellen told reporters on a September 15 press call. Per the report, Treasury will continue to evaluate a possible CBDC incase one “is determined to be in the national interest, Yellen said.

The second report broadly examines the interplay between crypto assets and consumers, investors, and businesses, especially underserved communities. In light of fraud, theft, and scams in the crypto arena, the report calls for more vigilance by regulators and law enforcement authorities to ward off bad actors. Further, the report recommends supervisory guidance be issued as needed to address current and emerging risks. The Financial Literacy and Education Commission should also be leveraged to direct taxpayers to trustworthy information sources on crypto.

Finally, the third report serves as an action plan for addressing misuses of digital asset platforms, such as money laundering. “The actions include strengthening U.S. AML/CFT supervision of virtual asset activities, disrupting illicit actors, expanding public-private dialogue, and improving global regulation and enforcement of international standards,” Yellen said.

Recognizing that the space is “rapidly evolving,” this report suggests the government should continue to monitor threats and solicit input from stakeholders. For its part, Treasury has invited the public to provide comment on “digital-asset-related illicit finance and national security risks” and the new framework. Comments can be sent via the Federal eRulemaking Portal and must be received on or before November 3, 2022.

“Innovation is one of the hallmarks of a vibrant financial system and economy,” Yellen said in a September 16 statement. “But as we have learned painfully from the past, innovation without appropriately addressing the impact of these developments can result in significant disruptions and harm to the financial system and individuals, especially our more vulnerable populations.”

spacer

Microchips in humans: consumer-friendly app, or new frontier in surveillance?

By Ahmed Banafa, September 8, 2022

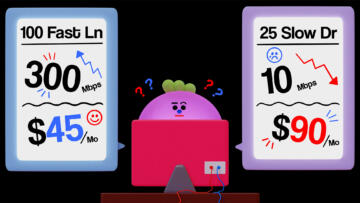

In 2021, a British/Polish firm known as Walletmor announced that it had become the first company to sell implantable payment microchips to everyday consumers. While the first microchip was implanted into a human way back in 1998, says the BBC News—so long ago it might as well be the Dark Ages in the world of computing—it is only recently that the technology has become commercially available (Latham 2022). People are voluntarily having these chips—technically known as “radio frequency identification chips” (RFIDs)—injected under their skin, because these microscopic chips of silicon allow them to pay for purchases at a brick and mortar store just by hovering their hand over a scanner at a checkout counter, entirely skipping the use of any kind of a credit card, debit card, or cell phone app. (See Figure 1 at top of page.)

While many people may initially recoil from the idea of having a microchip inserted into their body, a 2021 survey of more than 4,000 people in Europe found that more than 51 percent of respondents said that they would consider this latest form of contactless payment for everything from buying a subway Metro card to using it in place of the key fob to unlock a car door. (Marqeta/Consult Hyperion 2021).