I am thoroughly convinced that this entire “crisis” is just another orchestrated even to bring about the changes required for the New World Order. They want full control of the population. This is event created the opportunity for them to switch their manufacturing from milk based products to plant based products.

Since they are out lawing cows, milk can no longer be the main ingredient in baby formula.

Dutch government is making Dutch dairy farmers cull 95% of their herd, with Canada and Ireland following suite, to shrink greenhouse-emitting nitrates.

They have to switch to plant based in order to remain in business. It does not matter that it is PROVEN that MILK is the best source of nutrition for infants. If not mother’s milk than the milk of a cow, sheep or goat.

Wow, do you see the photo at the top of the page? I remember helping my mom with my younger siblings, and raising my own children, how careful we had to be when introducing new items into their diet. We had to take each vegetable and fruit one at a time s they grew old enough to tolerate them. We had to watch very carefully for signs of allergic reactions to the foods as we introduced them. MILK is the best food for babies. Now, they want you to believe that MILK is bad for babies and their “formula” should be plant based.

They don’t care if they starve little babies to death. It is a good way for them to keep their kill numbers up while the whole abortion debate is going on. They live off the blood of infants. They seen the deaths as collateral for their industry. No power is gained in the spirit realms without the shedding of blood. For bible believers, CHRIST is the only sacrifice required. But, for those who serve the dark side…they must sacrifice to flourish.

There is no natural reason for this so called crisis. The plant that supposedly started this whole thing did not even have a legitimate cause for shutting down. Yet, this continues. There are so many ways that this could have been prevented and even more ways it could have been resolved.

Besides giving the US manufactures a chance to switch gears, it also opened opportunity for foreign manufacturers to bring their products in. Part of the Global Initiative to bring about the One World Government.

spacer

If you have not seen my other posts on this topic, you can check them out here:

Formula SHORTAGE – WHAT IS REALLY GOING ON?

CRONOBACTER – Baby Killer

Seriously? The Baby Formula CRISIS WORSENS??

FORMULA FINDING ASSISTANCE

spacer

Baby formula shortage is easing for many, but it still isn’t over

By , CNN

Published 7:29 AM EDT, Tue August 2, 2022

To Watch The Video: CLICK HERE

About a month ago, Vicki Hankins and her husband were putting serious miles on their car while hunting for baby formula.

Now, instead of long drives every few days with uncertain results, they’ve been able to cut down to one long trip only once or twice a month. They don’t worry any more about being able to find formula – they just know they’ll have to travel to get it.

Experts who are closely tracking the state of the ongoing baby formula shortage in the United States say stories like the Hankinses’ are par for the course right now.

Formula availability is not back to normal, but for many families, it’s better than it was even a month or two ago.

Before a nationwide infant formula recall by Abbott Nutrition in February and the subsequent shutdown of one of the company’s major manufacturing plants, about 10% of infant formula products were typically out of stock, according to market research firm Information Resources Inc., known as IRI.

IRI’s latest report says about 20% of all types of baby formula products were out of stock during the week ending July 24 – the lowest out-of-stock rate since early June. Stock rates for powdered formula have been slower to recover. IRI data shows that about 30% of powdered formula products were out of stock the week ending July 24.

“There’s no question that the situation where families are going into the store and finding absolutely no formula has gotten much better,” said Dr. Steve Abrams, a neonatologist at the Dell Medical School at the University of Texas at Austin. “On the other hand, there are significant problems still in the system.”

The US Food and Drug Administration commissioner said last week that formula production needs to continue at high levels for six to eight more weeks for supply to keep up with demand.

Programs designed to help families affected by the shortage are being extended, too.

Back in May, Abbott announced that in states where it held WIC contracts, it would cover the cost of switching babies to different brands through August 30 – a signal that it expected the shortage could impact consumers for months.

Then in June, flooding from a storm again halted operations at Abbott’s Sturgis, Michigan, facility, delaying its production ramp up. The Abbott plant is producing specialty Elecare formula again – and shipping could begin “imminently” – but the company has extended its rebates to states for another month.

Families who depended on certain formulas have already had to pivot to find new ways to feed their babies, and they may still have to use different formula brands, travel long distances to find it and adhere to stores’ buying limits.

The Hankins’ 9-month-old son, Orrin, is allergic to ingredients in standard baby formula and needs a hypoallergenic variety. He had been on Similac Alimentum, which is made by Abbott. By June, they were no longer able to find it in stores.

They could order it online, but it wasn’t covered by benefits through Virginia’s Special Supplemental Nutrition Program for Women Infants and Children, or WIC. When they got it from retailers like Walmart.com, they had to pay for it out of pocket – an expense that strained the family’s budget.

So, in July, Hankins worked with her state WIC program to switch her son to a different brand of hypoallergenic formula called Gerber Good Start Extensive HA, which is being flown into the US from the Netherlands. It’s one of several overseas brands being sold in the United States since the shortage began.

Orrin had struggled to switch formula in the past, but he did great, Hankins said.

Still, the family travels about two hours round-trip from their home in Prince George County to get to stores that carry Orrin’s new formula. But Hankins said she can always find the right one.

On their last trip, they found it at Kroger and Publix stores right next to each other and bought the maximum allowed: four cans at one store and three cans at the other.

“We got to use our WIC benefits for the month in one trip, which was great,” Hankins said. “If I’m only doing that once or twice a month instead of every couple days, it really is such an improvement.”

Vulnerable families still hit hard

For families who can be flexible with the brands or types of formula they buy or the amount they can afford to pay, the shortage has eased considerably. But for others, the pain continues.

Hypoallergenic and easy-to-digest formulas are still in very short supply, and Abrams said families that need them face hardships. Hospital dietitians are scrambling to track them down for families. As soon as they find a formula that a baby can tolerate, it may run out before it’s even delivered to the family’s home. Then the process of prescribing and ordering starts all over again.

Families that depend on WIC program benefits have more limited choices, too. Not all stores accept their benefits, and not all states have given families the flexibility to purchase alternatives if their normal brand is out of stock.

Families in rural areas, who may have only one or two stores in their area that sell baby formula, may also be looking at long drives to find more if those stores run out.

The federal government has been working to alleviate the shortage. The US Food and Drug Administration eased rules allowing foreign manufacturers to sell their infant formula in the United States. In July, the agency said it was creating a framework to keep the door to foreign formula brands open permanently.

The Biden administration has sped the delivery of some of those cans through its Operation Fly Formula. As of July 24, the White House says, 17 Operation Fly Formula missions had delivered enough powdered formula to make more than 61 million 8-ounce bottles.

“There’s a backlog that’s having to be filled out, but we are seeing measurable improvement,” Dr. Robert Califf, commissioner of the US Food and Drug Administration, said Saturday on NPR’s All Things Considered. “There’s more formula on the shelves, and the production now is exceeding the demand by a significant amount every week. So we’re on the road to recovery, but I don’t want anyone to think we are sitting back at this point.”

He said that when consumers see empty spots on store shelves, it doesn’t mean that type of formula is entirely out of stock, but certain sizes of it might be.

| I looked all over the internet for video or still pictures of the efforts being made at our Baby Formula Plants to help resolve the Cirsis. I found none. The only photo I found inside a plant was this one at the Nestle Plant in Biessenhofen, GERMANY. It is not a photo related to the crisis but just a photo taken inside the plant. In this day of high tech cameras on every phone and video capabilities at an outrageous level of sophistication, where are all the photos, films, videos of the supposed efforts to resolve this crisis?? |

|

When formula manufacturers need to step up production, they cut back on the number of products they make to speed the process. “Whereas they may have, let’s say, been making a 1-pound, 5-pound and a 10-pound pack, they may reduce to just one type so that they can be as efficient as possible in turning out the formula,” Califf said.

The key now is to stay the course, he said.

“What we need is just to continue for the next six to eight weeks for the production to far outstrip the amount that people need for their babies, and then we’ll be back in good shape with regard to the volume of formula,” he said.

Still, the country is not quite out of the woods.

How much longer?

Abbott said in a statement to CNN on Monday that it will be shipping Elecare formula made at its Michigan plant “imminently,” and it’s working to restart Similac production “as soon as we can.”

Late last week, the US Department of Agriculture told states it would continue to cover the cost of non-contract infant formula to give families that receive WIC benefits – like the Hankinses – flexibility to purchase alternate sizes, forms or brands of formula. The benefit will continue through the end of September.

Geraldine Henchy, director of nutrition policy for the nonprofit Food Research & Action Center in Washington, said that although the extension is good news, “It does indicate that they believe that action is still necessary.”

About half of the baby formula bought in the US is purchased through the WIC program, and those families continue to be disproportionately affected by the shortage.

“The infant formula system crashed, but for WIC, it really crashed,” Henchy said.

The USDA has new powers through the Access to Baby Formula Act, which was signed into law in May. The agency recently announced that it would require state WIC programs to develop disaster plans in case of future baby formula supply disruptions.

The government is also making funding available to state WIC programs to speed the development of online ordering programs, since WIC families currently can’t use their benefits for online purchases.

GET CNN HEALTH’S WEEKLY NEWSLETTER

Sign up here to get The Results Are In with Dr. Sanjay Gupta every Tuesday from the CNN Health team.

Vicki Hankins says she feels like the hardest days of the shortage are behind her.

She has begun to see her son’s old brand, Alimentum, in stores closer to home, which has really helped ease her anxiety. She thinks that even if WIC stopped allowing her to use the Gerber Good Start Extensive HA, she could go back to what she was using before.

She knows that not every family has been so lucky. She hears from other moms on social media who are still struggling.

Henchy puts it another way: “I think it has really been traumatic for people.”

Why baby formula shortage is here to stay

The baby formula shortage that has plagued American families this spring isn’t over yet, according to a report from the research firm Information Resources Inc. (IRI).

Driving the news: About 20% of all types of baby formula remained out of stock during the week ending on July 24, the report said.

- Specifically, 30% of powdered baby formula products specifically remained out of stock for the week ending on July 24, per the IRI report.

- Before the shortage earlier this spring, 10% of baby formula products were out of stock, showing there’s still a deficit compared to normal numbers, CNN notes.

How it works: IRI used numbers from nationwide retailers for its report, including grocery and drug stores, mass merchants like Target and Walmart, military commissaries, and select dollar stores and club stores, IRI told Axios.

What they’re saying: “There’s no question that the situation where families are going into the store and finding absolutely no formula has gotten much better,” Dr. Steve Abrams, a neonatologist at the University of Texas at Austin, told CNN.

- “On the other hand, there are significant problems still in the system.”

Catch up quick: The U.S. first started experiencing a baby formula shortage after the Food and Drug Administration announced a recall of products made by Abbott Nutrition at a Michigan site.

- Abbott reached an agreement with the FDA to reopen the plant in May. The Michigan location didn’t resume production until July after a severe storm flooded the site.

What we’re watching: FDA commissioner Robert Califf told NPR last week that baby formula production will have to remain at high levels for another six to eight weeks to keep up with current demand.

- The FDA said in July it would look to help foreign baby formula producers secure long-term authorization for the U.S. in order to help stop a shortage from happening again.

spacer

Infant Formula Market Size to Reach USD 103.75 Billion by 2026 | Fortune Business Insights

Key Companies Covered in the Infant Formula Market Research Report Are Nestle S.A., Danone SA, Abbott, Arla Foods amba, Yili Group, The Kraft Heinz Company, Bellamy’s Organic, Perrigo Company plc, and more

spacer

BABY FORMULA is a very lucrative business. A major revenue producer.

spacer

Oct 02, 2019, 05:00 ET

PUNE, India, Oct. 2, 2019 /PRNewswire/ — Rising awareness about the nutritional benefits of infant baby products is spurring growth in the global Infant Formula Market. This shows that the demand for infant nutrition products will increase, with manufacturers embarking on designing the formulations that closely replicates the composition of breast milk. Despite a decrease in birth rates, infant milk formula is gaining huge attention primarily owing to the increase in working women population.

As per the report, the global Infant Formula Market was valued at USD 45.12 Billion in 2018 and is anticipated to surpass USD 103 Billion by 2026. Introduction of innovative packaging, premiumization, new changes in ingredient mix are driving the Infant Formula Market growth. This, coupled with the delivery of effective communication on product offerings, is expected to benefit the long-term growth of the market.

Fortune Business Insights in a new study, titled “Infant Formula Market Size, Share & Industry Analysis, By Type (Infant Milk, Follow-on-Milk, Others), Distribution Channel (Hypermarkets/ Supermarkets, Pharmacy/ Medical Stores, Specialty Stores, Others), and Regional Forecast, 2019-2026” states that the global market is anticipated to report a remarkable CAGR of 10.85% during the forecast period. The report sheds light on the detailed evaluation of the market based on segments, competitive landscape, and dynamics.

Browse Complete Report Details:

https://www.fortunebusinessinsights.com/industry-reports/infant-formula-market-101498

Researchers at Denmark and Japan Discovered New Infant Formula with Same Sugars as Breast Milk

List of the major key players operating in the global Infant Formula Market include:

- Nestle S.A.,

- Danone SA,

- Abbott,

- Arla Foods amba,

- Yili Group,

- The Kraft Heinz Company,

- Bellamy’s Organic,

- Perrigo Company plc,

- Reckitt Benckiser Group plc.,

- Royal FrieslandCampina N.V.

Sample Copy:

https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/infant-formula-market-101498

Of these, companies such as Danone SA, Nestle S.A., and Abbott are leading the market owing to their product portfolio. Other companies are also putting constant efforts to strengthen their position in the market.

Furthermore, the report offers detailed information on the important facets of the market which include drivers, restraints, opportunities, trends, and threats. The information collated in the report has been taken from several primary and secondary sources.

Expert’s Recommendation to Use Infant Milk Will Help the Segment Emerge Dominant

Among different types of infant formula, infant milk is expected to cover the major portion of the Infant Formula Market share. A lead analyst at Fortune Business Insights says, “The segment witnesses’ strong sales growth in emerging economies on account of the lack of substitutes in the market.” He added, “Owing to the lack of nutrient-dense and convenient products, manufacturers are planning to develop a plethora of new infant formulae products such as infant milk.”

In addition to this, physicians also recommend the use of infant milk than follow-on-milk owing to their superior nutritional value and is the best substitute for breast milk. The medicalization of infant milk formula addresses some of the general health conditions in infants and children which include constipation and indigestion. Considering the rising awareness about infant formula, consumers demand organic, 100% lactose, GMO-free and other product differentiations in infant milk products.

China Registers 11.30% CAGR and is the Fastest Growing Market for Infant Formula Products

United States: The Infant Formula Market in the U.S. was worth USD 2.66 billion in 2018 and is projected to reach USD 5.07 billion by 2026. The market is expanding owing to the rising focus on value-added infant formulae with the best ingredients and regulatory practices. The intervention from public sector coupled with the efforts from key brands have led to effective penetration of infant nutrition products among almost every households of the country irrespective of varied ethnicity. As per the report, the market is expected to rise at a CAGR of 8.30% in the forecast years.

China: The market in China is anticipated to register a CAGR of 11.30% between 2019 and 2026. The elimination of ‘one-child’ policy and rapid consolidation of the domestic industry are factors creating growth opportunities for the market in China. Also, the rising awareness about infant care and nutrition is enabling growth in the market, augmenting the Infant Formula Market size in Asia Pacific.

Some of the developments marked by the report are:

January 2019: A subsidiary of Arla Foods Amba called Arla Foods Ingredients revealed a new infant formula concept called easy digest whey protein. The company aims to reduce gastrointestinal issues by changing the number of proteins used.

August 2019: Danone Nutricia announced the launch of a new and advanced infant formula called Karicare Toddler. This product is made with pure New Zealand sheep milk.

September 2019: Researchers at the Technical University of Denmark and Kyoto University discovered a new infant formula which is as good as breast milk. It contains the same sugars and can be given to children who are not breastfed.

Request for Customization: https://www.fortunebusinessinsights.com/enquiry/customization/infant-formula-market-101498

spacer

If you don’t believe me when I say this was created to give the manufacturers an opportunity to switch from milk based to plant based formula…check out these links.

spacer

Baby formula by the numbers: Facts about the multibillion dollar

Worldwide Baby Food and Infant Formula Industry to 2027 – Featuring …

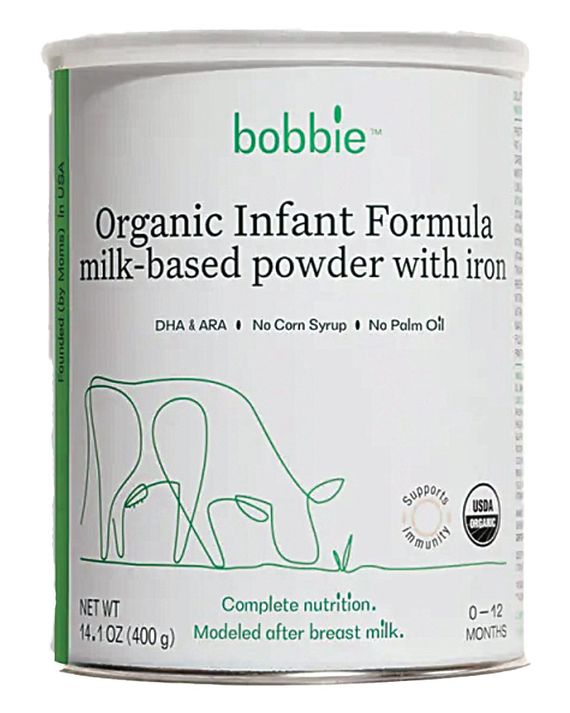

Milk Money

The national baby-formula shortage that wreaked havoc for parents created an opening for start-ups competing in the $4 billion market.

This article was featured in One Great Story, New York’s reading recommendation newsletter. Sign up here to get it nightly.

One night in 2016, Laura Modi was facing an acute episode of an eternal parenting problem: trying to get your infant to eat. Modi had just given birth to her first child, a girl, and she was attempting to breastfeed, in part because she wanted to and in part because the American Academy of Pediatrics encouraged it. But Modi was struggling to produce milk and dealing with mastitis, a painful breast-tissue inflammation that can lead to infection — just two of the many medical, professional, and societal obstacles that can make breastfeeding impossible. Like three out of four new parents, Modi was going to have to use formula to keep her infant fed.

As Modi paced the aisle of a pharmacy in San Francisco, where she worked as Airbnb’s director of hospitality, the decision didn’t feel so simple. She was fighting off a fever, her daughter was screaming, and she couldn’t kick the feeling that she had somehow failed. The cans on the shelf didn’t look like the kinds of products that parents like Modi — millennial, coastal, Whole Foods shoppers — were used to buying. The formula was packaged in primary colors and had a list of multisyllabic ingredients on the back: cholecalciferol, cyanocobalamin. And some of them used corn syrup? Forget about it. Feeding her child a can full of powdered ingredients she would never buy for herself felt like a betrayal. In the harsh fluorescent glare of a late-night drugstore aisle, Modi came face-to-face with the emotion that dominates much of 21st-century parenting: the feeling that no matter how much you are doing for your baby, it is never enough. Modi says she was so embarrassed by the can of Similac she bought that she hid it in the back of her cabinet.

Luckily for Modi, she was struck by two other powerful feelings: “a mother’s intuition that there had to be a better option” and a disruptor’s nose for an opportunity. Her comrades elsewhere were already optimizing breast pumps and outfitting bassinets with “smart technology.” They had even invented Soylent, a formula for adult babies.

But no one had touched the $4 billion domestic market for infant formula, which had been dominated for decades by just three large corporations. “We know science has evolved; we know consumer taste has evolved. So why is it that I’m buying the same boomer brands that existed 40, 50 years ago?” Modi told me recently, after recounting her well-worn founder origin story. “Infant formula is one of the last remaining industries where we haven’t seen some level of disruption. That was appealing.”

In 2018, Modi left Airbnb to start Bobbie, named after the word her daughter used for her bottle. Bobbie promised American parents something they couldn’t find at CVS or Target: a “European style” formula, closer in recipe to what mamans and Mütter were serving in Lyon and Berlin. It cost more than three times as much as standard American formulas but came with organic milk and the trappings we’ve come to expect from hip direct-to-consumer brands: a package delivered to your door with a soothing Key-lime-green font and printed with an image of Bobbie’s bovine mascot, Moonique, who is meant to represent all the grass-fed cows who produce the formula inside. Modi says she “wanted to create a formula that wouldn’t leave me with even more mom guilt,” and Bobbie was calibrated to help millennial parents — today’s primary childbearing demographic — feel less stressed about one of the countless choices they have to make. She closed a $2.4 million seed-funding round a week before giving birth to her second child.

Bobbie launched three years later, in 2021. It only took a year for Moonique to become a critical component of America’s supply chain. In February 2022, following the deaths of two infants seemingly from a bacterial infection from contaminated baby formula, an Abbott Laboratories plant in Sturgis, Michigan, that makes its Similac formula was shut down after the Food and Drug Administration launched an investigation. (No concrete link has been established between the infections and formula produced by Abbott; Abbott announced a voluntary recall on February 17.) The plant produced a fifth of all formula in the U.S., and neither the industry nor the government seemed to have a plan for what to do. By May, many retail shelves were empty. Desperate parents resorted to driving from store to store for hours, deploying internet shopping bots, serving dangerously watered-down bottles, and cooking up homemade formulas with recipes that dated from the Eisenhower administration. At least two children were hospitalized as a result of the shortage.

Modi is careful not to talk about the shortage as a business opportunity — but that’s what it was. She had hoped to disrupt an industry, then the industry had disrupted itself. New parents are reluctant to switch infant-formula brands so long as their babies aren’t spitting it up, but the shortage gave some of them no choice: An expensive formula looked like a good deal as long as it could get to your door. Within a week of the Sturgis shutdown, Bobbie’s sales doubled; eventually, the company was so overwhelmed with orders that it had to stop taking new customers. By August, it had scored a spot on the shelf in Target stores nationwide, right alongside the cans Modi had once objected to.

Formula supplies remain low in parts of the country with Abbott announcing last week that the Sturgis plant would finally start producing Similac again. But the crisis has started to recede, opening room for questions about the future of an industry revealed to be broken — and who will profit. Bobbie isn’t alone in having good timing. In March, just weeks after the recall, Ron Belldegrun and Mia Funt, two siblings in Manhattan, launched another direct-to-consumer formula company called ByHeart that promised its own special recipe. ByHeart’s sales exceeded projections by 15 times, and it too had to stop taking new customers. Both companies have collectively raised more than $250 million in venture capital on the notion that nearly 3 million American infants are formula-fed every year, and that capturing the kind of parents wooed by Moonique and organic ingredients — and willing to spend any amount to give their child every perceived advantage — could be wildly lucrative.

A critical reading of ByHeart and Bobbie is that they are Goopified versions of cheaper formulas that already exist, and which are every bit as nutritious — that they are catering to consumer preferences, rather than pediatric ones, and preying on the “mom guilt” Modi promised to alleviate. A different interpretation, which Bobbie and ByHeart are promoting, is that they are transformational businesses in the classic start-up mode, breaking into an industry that has grown complacent. “I got into this to reform this industry,” Modi told me multiple times. When I spoke to the founders of ByHeart, they seemed genuine but also used variations of the word innovate more times than any start-up founder I’ve ever met — and I once spent half an hour with Adam Neumann. Both companies launched into a crisis and pitched themselves as heroes. They promised to deliver American parents from their latest insecurity — at least so long as they didn’t create a new one.

|

|

The quirks of the baby-formula industry that made room for ByHeart and Bobbie — and led to the shortage this year — have been brewing since the 1950s. The postwar baby boom introduced new customers, and developments in formula-making brought convenience that outweighed the cost. Similac (“similar to lactation”) came to market in 1951, followed a few years later by Enfamil (“infant meal,” if you squint). They remain the predominant formulas today. Younger mothers were especially quick to adopt a product that promised scientifically calibrated benefits as well as liberation from the tyranny of breastfeeding. The early 1970s saw the lowest rates of breast-feeding in decades — only 6 percent of infants were being breastfed six months after birth — and in 1980, a researcher in New York City’s Bureau of Maternity Services said that, for some women, the ability to feed your child formula was “a kind of status symbol.”

But the industry had also come into disrepute. Nestlé and other companies were using salespeople dressed as nurses to push formula in developing countries, where parents sometimes unknowingly overdiluted their formula or mixed it with contaminated water. Breastfeeding rates started to rise again, and, in 1980, Congress passed the Infant Formula Act, which set nutritional and safety requirements managed by the FDA. “This is much more like producing a drug than a food,” says Belldegrun, the CEO of ByHeart, who started the company after spending eight years at a health-care-focused hedge fund. The regulations brought welcome standards and reassurance for parents but also made breaking into the market even more difficult. Since 1980, Abbott and Mead Johnson, which makes Enfamil, have controlled more than 80 percent of the market.

That consolidation was cemented by the federal government’s Special Supplemental Nutrition Program for Women, Infants, and Children — WIC, for short — a crucial program that provides nutritional support for lower-income families. WIC has always encouraged breastfeeding, but it also covers the cost of formula. During the 1980s, formula prices increased by more than 150 percent, vastly outpacing the price of milk. In response, President George H.W. Bush mandated that each state run a competitive process in which the lowest bidder would win an exclusive contract to sell formula to WIC families. (The program is federally funded but administered separately by each state.) The system limited choices for lower-income families but worked as a cost-cutting measure. States now pay as little as 15 percent of the retail price, saving taxpayers more than a billion dollars every year. The large players that dominate the industry — since the mid-’90s, every WIC contract in all 50 states has gone to Abbott, Mead Johnson, or Nestlé — are willing to make this deal not only because the program accounts for more than half of all baby formula sold in the U.S. but also because retailers are more likely to stock the WIC-approved formula, which can then be sold to other consumers at retail prices. When California switched its contract from Similac to Enfamil in 2007, Enfamil’s share of the state’s market grew from 5 to 95 percent.

Modi encountered the industry’s barriers to entry right away. In 2019, she and her co-founder, Sarah Hardy — Modi’s “work wife” from Airbnb — launched a trial with 100 families in San Francisco, offering a “companion” formula for toddlers. But confusion about its marketing, and whether it could be safely served to an infant, got the attention of the FDA, and Bobbie voluntarily recalled its product. When Bobbie relaunched in 2021, its formula was made by Perrigo, a white-label manufacturer that helps new brands get to market by creating recipes that don’t run afoul of FDA rules.

The powdery contents of baby formula are one of the many mysteries that greet new parents. So what is it? The primary ingredient in most formula is milk, most often from a cow and typically skim. The milk is mixed in a giant vat with a protein called whey; a sugar, usually lactose, which serves as a necessary carbohydrate for growth; and several different vegetable oils — sunflower, safflower, rapeseed, soybean — that provide babies with the fatty acids they need to grow. Sprinkle in some vitamins and minerals meant to approximate some of the contents of breastmilk, and maybe toss in a prebiotic, then run the mix through a spray dryer to turn it into a powder. Mix with water, and serve. There are different recipes for babies born prematurely, or who suffer from particular allergies, but most pediatricians agree that as long as your baby is drinking the stuff, there is little functional difference between most formulas on the market.

But this is modern parenting, which means the situation could not be so straightforward. In the formula world, there are now countless websites that scrutinize the variable nutrient levels of every product. Abbott alone produces a dozen versions of powdered Similac, including several designed “for fussiness and gas.” Lisa Richardson, a pediatric dietitian who runs the site Formula Sense, told me that many of these were “solutions in search of a problem.”

The aesthetic and ethical preferences of millennials have followed them into parenthood. Instead of Pampers, there are Jessica Alba’s plant-based diapers printed with avocados and sweet potatoes; instead of Desitin, you can buy Kristen Bell’s diaper-rash cream, packaged in millennial pink; and if Gerber doesn’t feel good enough, Jennifer Garner sells squeezable pouches of organic baby goo. (The old-school brands, including the formula giants, now have organic versions, too.) A tech company called Hatch Baby — no relation to the bougie maternitywear brand of the same name — makes a diaper-changing pad that doubles as a scale, allowing nervous parents to keep track of their baby’s weight after every feeding rather than waiting for their next pediatrician’s visit. If there is something for a parent to fret about, there is likely a product promising to ease their mind.

Modi’s decision to position Bobbie as a European-style formula was driven by a market demand: Many parents in her cohort had suddenly begun taking the drastic step of importing formula from Europe. A study from 2018, the year Bobbie launched, found that 20 percent of formula-feeding parents at a New York City pediatrician were importing formula from Europe. (The demographic most likely to do this: white moms with college degrees and household incomes greater than $200,000.) Only 8 percent had received any guidance about European formulas from their doctor, but the survey respondents said they had become convinced that imported formula was the healthier choice for their babies. In short: Brest was best. “I remember being on Park Slope Parents” — a notoriously hyperactive online forum — “and people would post at the beginning of summer, ‘Is anyone going to Europe? I will pay you whatever you want to smuggle formula back for me in a suitcase,’ ” one parent of two children who are safely beyond formula-drinking age told me. Bobbie sells cans measured by the gram — the European way — and the company’s Instagram profile advertises the brand as “Organic Infant Formula for your bébé.”

There are differences between American and European formulas both in what regulators require and in what they prohibit. (Europe, in general, has stricter regulations about the use of pesticides.) But there is no scientific evidence that European formulas are safer or more nutritious than American ones. While Modi had been concerned about all the scary-looking words on the formula cans, they were there because FDA regulations require listing scientific ingredient names, such as cholecalciferol and cyanocobalamin; European companies can use their common names, vitamins D and B12. Many parents blanch at the inclusion of corn syrup in some American formulas, but it’s not the high-fructose kind and is only used in formulas for babies who can’t tolerate lactose. In a post on Formula Sense, Richardson gave a rating of “three dirty diapers” to the claim that European formulas “are more like breastmilk,” noting that both “have extremely similar nutrient profiles.”

But consumers wanted it, and having formula delivered by an American company rather than imported through the black market was appealing. When ByHeart launched this year, it did so without the explicit European connection, focusing on the fact that it is the only U.S. formula that uses whole milk, rather than skim, which some pediatricians believe is a promising innovation. ByHeart conducted a clinical trial — 100 babies on its formula, 100 breastfed babies, and 100 babies on Enfamil — in which the authors found that ByHeart’s babies spat up less than the Enfamil kids and showed “more efficient growth.” Bobbie and ByHeart have inevitably been compared to each other, and many pediatricians are glad to have new products pushing the established players in the market. But if you’re going to pay more than three times the cost of Wirecutter’s pediatrician-approved recommendation — a Costco generic, also produced by Perrigo — how to choose? Do you like the idea of ByHeart’s whole milk or Bobbie’s two extra milligrams of DHA, a fatty acid that studies suggest is critical for brain function? And before you make any final decisions, are you really okay giving your child a formula without taurine, a nutrient found in breastmilk that studies show may or may not be beneficial to your kid? Neither ByHeart nor Bobbie have any.

Both start-ups insist that the stuff inside their cans is what attracts parents. “People come to us for a simple reason: ‘Baby eats it, baby doesn’t spit it up, and baby shits it out well,’ ” Kim Gebbia Chappell, Bobbie’s vice-president of marketing, told me. But they have both put effort into making parents feel good about the choice they’re making. Modi has spoken about Bobbie as a product that should “spark joy,” as if she were selling The Life-Changing Magic of Not Spitting Up. Each can of Bobbie is printed with a quirky sticker — MILK DRUNK IN LOVE, BOTTLE SERVICE — and the company’s website features a diverse set of parents. ByHeart’s chief brand officer previously worked for J.Crew and Hatch, the Alex Mill of maternitywear, and has published a book on modern French couture. Both companies market their products as gluten free, even though virtually every formula is gluten free by default. “We did the work on everything from what’s in the formula to social — everybody else had overlooked this, and it’s the stuff that matters to millennial parents,” Chappell said. “We normalized what it means that you are unboxing your formula on Instagram — Reeves, this did not happen before Bobbie.”

In June, President Biden held a roundtable with formula-company executives to discuss long-term solutions to the shortage. The government had followed the lead of Park Slope Parents and was now flying formula in from Europe, but the 60 million bottles arriving from the Netherlands, Switzerland, Germany, England, and Australia were a temporary salve: They amounted to a week’s supply. While Abbott was notably absent at the roundtable, Belldegrun had scored an invite. ByHeart’s launch just weeks after the Sturgis shutdown had been fortuitous and hectic. “My wife and I just had our second this past weekend,” Belldegrun told the group.

“Good luck with the new babe, ol’ buddy,” Biden said.

ByHeart had scored a seat, rather than Bobbie, because the company had taken a different path to market. Instead of going through Perrigo, the white-label manufacturer Modi had used, Belldegrun and Funt decided to create a recipe from scratch that would have to go through a clinical trial to get approved, and to buy a factory of their own. The facility in Reading, Pennsylvania, is the first new formula plant approved by the FDA in 15 years. This had been costly — ByHeart has raised nearly three times as much money as Bobbie — but when the shortage hit, the company was better able to position itself as a potential solution. Belldegrun told Biden that his company was waiting on approval from the FDA to open two additional facilities and that ByHeart believed it was on a path to feed 500,000 babies — more than 10 percent of American infants, enough to challenge Nestlé for third place. Belldegrun told me ByHeart expected to hit that target within two years and had even more ambitious goals. “We didn’t go buying factories, and conducting clinical trials, and raising $190 million to be a one-product company,” he said. “We built this to be a nationally accessible brand.” He suggested that ByHeart would be expanding into specialized recipes and “showing up as a feeding partner throughout the nourishment continuum from pregnancy through toddler.”

When Modi and I spoke in August, six months after the recall, she said that Bobbie still had “tens of thousands of people” on its waiting list. She wanted to increase production, but doing so would take months. Bobbie had even asked its “suite of influencers” to stop posting about the product. In a time of genuine crisis, the classic start-up playbook — virality, growth at all costs, breaking things — simply didn’t work. “For us to increase production, we need to invest in manufacturing,” she said. “That will take years, not months.”

Neither start-up is in a position to solve the formula crisis, but they are both interested in shaping the industry’s future. Modi had moved to Washington, D.C., mostly to be a few time zones closer to her family in Ireland, but she admitted that “it doesn’t hurt” being close to the policymakers who will play a large role in determining her company’s future. In September, the White House is hosting a conference on health and nutrition — the first in more than 50 years — and Politico recently reported that this summer saw a “mini lobbying boom” around the formula industry. Bobbie and ByHeart both hired lobbyists, and the major players were devoting additional resources to courting lawmakers. (Even Amazon has gotten involved: WIC sales currently have to take place in a store, but Amazon is hoping the crisis might push the government to allow them online.) One possibility is giving WIC families more choice about which formulas they can buy; an Ohio Republican has introduced the Improving Newborn Formula Access for a Nutritious Tomorrow Act — yes, it spells INFANT — to that effect.

The FDA also announced that it was considering allowing European imports permanently. Both Bobbie and ByHeart support this in the short term, but a lasting shift would put them in a bind. Modi has long argued that European formulas were special and that its domestic imitation of them was the crucial advantage Bobbie offered to parents. Now, she was arguing that we should be wary of anything crossing the Atlantic. “The moment we take a temporary solution and apply it permanently raises a lot of questions,” she said, asking how the FDA would guarantee safety and manage recalls from abroad. She cautioned against “a ‘made in China’ situation.” Christina Berberich, Bobbie’s head of regulatory and safety issues, who previously worked at Abbott, echoed Modi’s concerns. But when I asked Berberich whether European formula had a history of safety issues or recalls worse than the U.S., she couldn’t point to anything in particular.

As an alternative, both Modi and Belldegrun said they hoped the government would support more domestic manufacturers. Modi said that could be Bobbie’s future, and with all of the market disruption this year, other competitors will almost certainly emerge. Several start-ups, here and abroad, have spent the past few years trying to develop a formula derived from breastmilk stem cells. Max Rye, the co-founder of a company called TurtleTree Labs, has said its attempt to create infant formula is merely a test case for a more ambitious goal: “to replace all milk.”

So what’s a dedicated, caring, and confused parent to do? The FDA has proved itself unworthy of our blind faith, as has the biggest company in the industry — but the past decade of blitzscaling start-ups hasn’t necessarily given us reason to put a critical food source in the hands of people new to the business. The theoretical arrival of stem-cell breastmilk isn’t likely to make the choice any clearer.

Modi often talks about her company as a “cultural movement,” as start-up founders tend to do. Her particular mission, she says, is to fight the stigma that forced her to shamefully hide her formula can in her pantry, and to put formula feeding on equal footing with breastfeeding. When Bobbie launched its first major marketing campaign last year, it intentionally did so in August — National Breastfeeding Month. “Did we poke a few bears? Yes,” Chappell told me. “But we like to say that we are radically centrist.”

This is a favorite Bobbie catchphrase, meant to position the company between Big Bottle — the makers of Abbott and Similac — and “what we call ‘lactivists,’ ” as Chappell put it. Breastfeeding rates in America have gone up and down over the years, driven by medical discoveries, activism, and political and societal choices. (Some studies have shown higher rates of breastfeeding in countries with paid parental leave.) Neither ByHeart nor Bobbie would argue their formula is more nutritious than breastfeeding — a ByHeart ad: “Breast is best. We’re next” — and both the medical Establishment and those skeptical of it recommend breastfeeding whenever possible. But the exact benefits are unclear. It’s difficult to separate breastfeeding from other factors, and clinical trials are hard to design: No ethical researcher is going to blindly assign different feeding practices to new parents in a maternity ward.

The American Academy of Pediatrics didn’t necessarily help matters this summer, when it released its first updated guidance on breastfeeding in a decade. The AAP renewed its recommendation that infants breastfeed exclusively for six months — but it encouraged parents to continue doing so for a full two years. Many exhausted mothers threw their breast pumps across the room. The AAP said its goal wasn’t to stigmatize parents who use formula but rather, in fact, to fight a different stigma, against parents who choose to breastfeed their children. In 2021, the journal Maternal & Child Nutrition published a paper titled “Guilt, Shame, and Postpartum Infant Feeding Outcomes: A Systematic Review.” The paper found that whether parents choose to breastfeed or give their infant formula — well, pretty much all of them feel like failures.

The pandemic years have taught us a lot about the difficulty of public-health messaging, but it’s still depressing to see the system fail on a topic as fundamental to the species as feeding infants. Modern parenting has become a buffet of choices with no perfect option and a battle against stigmas on every flank. Bobbie’s mission to destigmatize formula feeding even risked creating a negative perception of its own: that parents who can’t afford its formula weren’t giving their kid the same chance as parents they saw posting about Moonique on Instagram. “Are we creating second-class-nutrition citizens?” Richardson, who runs Formula Sense, asked me. “The most innovative formula from ten years ago — that’s what the WIC kids get.”

Modi was aware of that danger. “ This probably is the biggest thing that keeps me up at night,” she said. “This is not a situation where Kind Bar can say something critical about Clif Bar. Shame on any formula company or brand for positioning another formula in a bad light.” The right answer to all of this was to support parents no matter what choice they made. Doing so would require meaningful parental-leave policies, boosting the funding for the WIC program, better guidance and more understanding from health-care providers, and generally relieving parents of the anxious feeling that their best isn’t enough. But where’s the profit in that? Modi was still in pitch mode when I asked her about this, insisting there was “room to uplevel” the standard for formula in the U.S. But she also offered a message to parents that would have been comforting to her younger self: “If you feed your baby Similac, like I did with my first child, your baby is going to be perfect.”